🚀 September 2025 Performance Report 🚀

630.42% total PnL | 65.96% win-rate | 47 trades | 31W / 16L

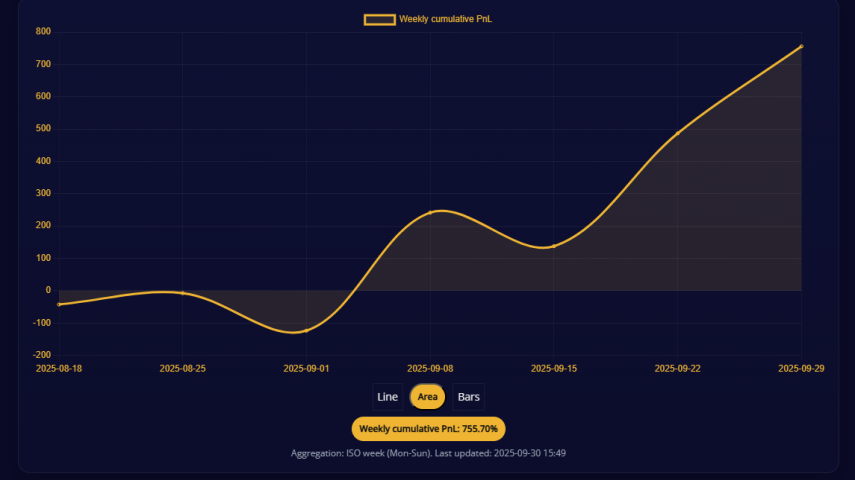

September was our kind of month — volatile, opportunity-rich, and tailor-made for systematic execution. CubeBase’s bots stayed locked on momentum reversals and breakouts, delivering +630.42% cumulative PnL with a 65.96% WR across 47 trades. The equity curve climbed week after week, with the dashboard’s Weekly Cumulative PnL peaking ~622.74% by month-end.

September Trade Log (highlights by week)

Week of Sep 1–7:

Choppy open. A rough TIA/USDT short (-101.02%) stung early, but PLUME/USDT long (+125.44%) pulled momentum back in our favor.

Week of Sep 8–14:

AI and infra pairs started trending. TRB/USDT long (+101.10%), ZEREBRO/USDT short (+120.86%), AVAAI/USDT short (+119.55%) aided a strong push.

Week of Sep 15–21:

Breadth day: BAKE/USDT short (+97.49%), PLUME/USDT short (+31.39%) and multiple mid-range wins offset a few notable reds (e.g., CROSS/USDT short -93.30%).

Week of Sep 22–29:

Our best stretch. A cluster of shorts worked:

AI16Z/USDT short (+140.04%), SKYAI/USDT short (+71.36%), PI/USDT short (+14.90%), PENGU/USDT short (+30.00%).

We closed the month with M/USDT short (+136.01%) and H/USDT long (+136.05%) — two late surges that locked in the headline PnL.

How the CubeBase stack delivered (under the hood)

Signal Engine: Our trading bots pipeline parses momentum shifts and liquidity pockets, then routes trades to the tracker.

Risk Framework: Hard exits on invalidation, reduced sizing on low-liquidity tokens, and time-based decay for stale setups.

Tracker UX:

Public Profit Curve (weekly aggregation)

Wins / Losses / WR badges

Open Trades widget

CSV imports + DB sync to mirror real execution flow

Community Layer: Community contests (Raid Castle, Roll-the-CubX) to reward engagement around the CUBX ecosystem.

Closing Note

Markets reward discipline over dopamine. September’s +630% wasn’t a lottery ticket — it was process: identify flow, take the high-probability side, cut the noise, and let the math do its work. On to October.