16 - 21 December Weekly recap

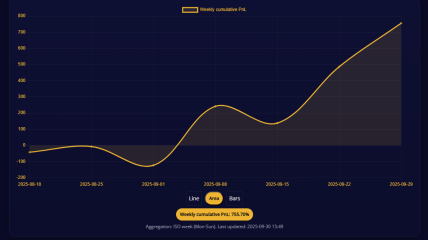

The cryptocurrency market experienced significant volatility this week, marked by notable price fluctuations and influential developments.

Bitcoin's Volatility

Bitcoin (BTC) surpassed the $100,000 milestone earlier in the week but subsequently declined. As of December 21, 2024, BTC is trading at approximately $97,303, reflecting a 1.75% increase over the previous close. The intraday high reached $99,496, with a low of $95,629. This downturn is attributed to the Federal Reserve's recent indications of fewer interest-rate cuts in 2025, which have dampened market sentiment.

Altcoin Movements

Ethereum (ETH) is currently priced at around $3,351, showing a 1.66% decrease from the previous close, with intraday trading between $3,558 and $3,328. Other major cryptocurrencies such as BNB, XRP, and Solana (SOL) have also experienced declines, reflecting the broader market's downward trend.

Market Sentiment and Influences

The overall market sentiment has been cautious, influenced by macroeconomic factors and regulatory developments. The Federal Reserve's stance on interest rates has notably impacted investor confidence, leading to reduced risk appetite in both equity and cryptocurrency markets.

Notable Events

The election of President Donald J. Trump has introduced a pro-crypto stance, which initially boosted market optimism. However, the subsequent regulatory uncertainties have contributed to market volatility.

Conclusion

This week's developments underscore the cryptocurrency market's sensitivity to macroeconomic indicators and regulatory signals. Investors are advised to monitor these factors closely, as they are likely to continue influencing market dynamics in the near term.